China's import volume of corn skyrocketed in Feb. 2016. According to China

Customs, import volume of corn (not for seed) reported a MoM soar of 679.77%,

being 62,272 tonnes in Feb. Meantime, the import price was USD197/t, down by

48.79% MoM, hitting a record low since Jan. 2014.

Notably, China exported 600 tonnes of corn in Feb., the figure was 0 in Jan.

(price: USD380/t).

The skyrocketed import volume of corn is mainly ascribed to following factors:

Very low import volume in Jan. According to

China Customs, China imported 7,986 tonnes of corn in Jan. 2016, a record low

since Jan. 2014.

Low import price of corn. In China, the rising salaries (labor cost) and the

real estate craze (rents of land) led to the soaring production cost. However,

the production cost of corn in the US is about 1/2 of that in China. The low

costs pull down the import price of corn. In Feb., the import price of corn was

USD197/t, while the domestic market price was averaged at USD303.56/t

(RMB1,989.5/t).

Import volume of corn from Ukraine

increased. China increased the import volume of grains from Ukraine based on

the China-Ukraine Loans for Grains Agreement signed in 2012.

China imported

4.73 million tonnes of corn, among which 3.85 million tonnes was from Ukraine,

a proportion of 81.44% of the total, according to China Customs. Ukraine

surpasses the US to be the largest import origin of corn in China. In Feb. 2016,

52,500 tonnes of corn was imported from Ukraine, 84.3% of the total vs. 0.65%

from the US.

Major import origins of corn in China, 2015

Source: China Customs

Although import volume soared in Feb., CCM predicted that it would fall back in

later period, because:

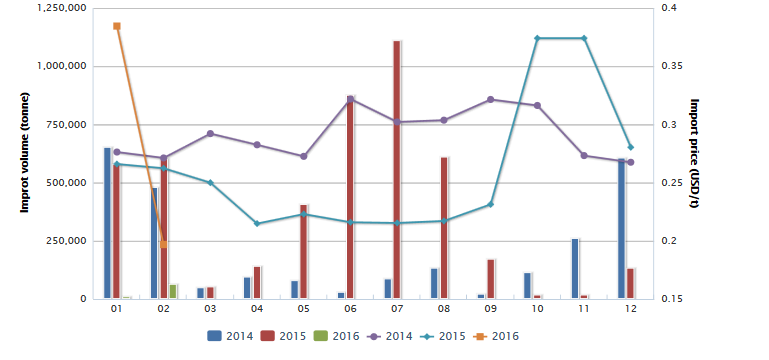

- Import volume is shrinking when compared to previous years.

Data from China Customs show that although the import volume of corn had a YoY

rise of 82.02% in 2015, the figure has largely decreased since Q4. It is the

falling domestic market price that reduces the price advantage of imported

corn. In fact, the import volume in Feb. 2016 has fallen a great deal when

compared to the same period last year, accounting for only 10.32% of that in

2015, and 12.98% of that in 2014.

This indicates that enterprises have low

enthusiasm for importing. CCM believes that import volume won't remain high and

will even fall in the future if the market price keeps falling and the demand

from downstream sectors remains weak.

- The inventory maintains high and the domestic demand is saturated.

As of March 2016, the purchase volume of corn for temporary storage reached

10,743 tonnes, according to the Ministry of Agriculture of the People's

Republic of China.

It is estimated that the state's corn inventory has

surpassed 250 million tonnes. The Chinese government set up directional selling

and reformed the purchase policy for temporary storage, aiming at consuming the

huge inventory. Therefore, domestic corn inventories will be consumed first and

the demand for imported one will reduce.

Imports of corn in China, Jan. 2014-Feb. 2016

Source: China Customs

Want to know more about CCM's food and feed market products? Click here and download our sample!

This article comes from Corn Products China News 1604, CCM

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us directly by emailing

econtact@cnchemicals.com or calling +86-20-37616606.

Tag: corn